Is it mandatory for me to file an Income Tax Return if I have a PAN?

No. The following points explain this clearly:

- You need to file an Income Tax Return if your Total Taxable Income exceeds the basic exemption limit before taking into account deductions, i.e., tax saving investments.

-

The basic exemption limit for financial year 2019-2020 is as under:

-

Gender, Age & Residential Status Basic Exemption Limit Resident Female & Others Rs.2,50,000 Resident Senior Citizen

(Age > = 60 yrs and < 80 yrs as on 31st March of Financial year)Rs.3,00,000 Resident Very Senior Citizen

(Age > = 80 yrs as on 31st March of Financial year)Rs.5,00,000

- You do not need to file an Income Tax Return if your total taxable income does not exceed the basic exemption limit before taking into account deductions, even though you may have a PAN.

What is the tax rate of financial year 2019-20?

Income Tax Slab Rate for AY 2020-21 for Individuals:

-

Individual (resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year:

Taxable income Tax Rate Up to Rs. 2,50,000 Nil Rs. 2,50,000 to Rs. 5,00,000 5% Rs. 5,00,000 to Rs. 10,00,000 20% Above Rs. 10,00,000 30%

-

Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

Taxable income Tax Rate Up to Rs. 3,00,000 Nil Rs. 3,00,000 to Rs. 5,00,000 5% Rs. 5,00,000 to Rs. 10,00,000 20% Above Rs. 10,00,000 30%

-

Resident super senior citizen, i.e., every individual, being a resident in India, who is of the age of 80 years or more at any time during the previous year:

Taxable income Tax Rate Up to Rs. 5,00,000 Nil Rs. 5,00,000 to Rs. 10,00,000 20% Above Rs. 10,00,000 30%

Plus:

Surcharge: 10% of tax where total income exceeds Rs.

50 lakh 15% of tax where total income exceeds Rs. 1 crore

Health and Education Cess: 4% of tax plus surcharge

Note: A resident individual is entitled for rebate u/s 87A if his total income does not exceed Rs. 5,00,000. The amount of rebate shall be 100% of income-tax or Rs. 12,500, whichever is less.

Who can file an Income Tax Return using Taxsmile?

Any Individual having the following types of income can opt for Taxsmile's services:

- Income from Salary

- Income from One House Property

- Income by way of Interest, Dividend, Gifts, Family Pension, Agricultural Income

What is the Last Date for filing an Income Tax Return?

The Due Date of filing your Income Tax Return for a financial year is 31st July (extended till 30th november this year) after the end of the financial year. Thus, for financial year ended on 31st March, 2020, the due date of filing Income Tax Return is 30th November, 2020.

Does that mean that I cannot file return after the last date mentioned?

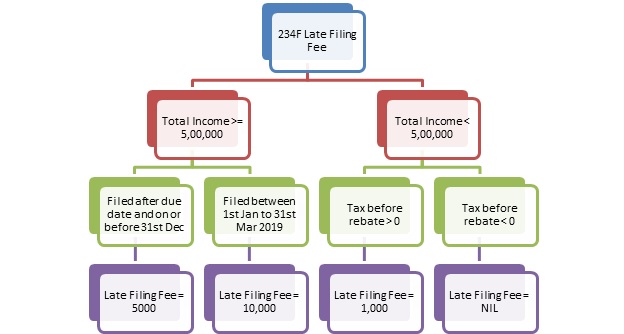

You can file return after the last date also. However, in such case you will have to pay penalty interest @ 1% per month for late filing and late filing fees as per below chart. In case you have not filed your Income Tax Return for the financial year ended on 31st March, 2020 till 30th November, 2020, still you can file the same till 31st March, 2021. Beyond which the return will become time barred and you would not be able to file the same.

Why is filing an Income Tax Return using Taxsmile a unique experience?

Taxsmile offers you a unique experience when filing your tax return. Find out how:

- You do not need to know Income Tax Laws.

- The tax computation is done absolutely FREE. You can also view it for free. You pay only when ready to file.

- Taxsmile is a Registered e-Return Intermediary by the Income Tax Department. So we can file your return with the IT Department on your behalf.

- Taxsmile uses 128-bit encryption Secure Sockets Layer (SSL) technology, used by banks around the world. Our servers are the safest home for your data!

- No advertisements or pop-ups on the Taxsmile website.

- You can prepare and file your return for various types of Income. Taxsmile does not place restriction on income types in its plan.

What are the steps for filing an Income Tax Return using Taxsmile?

- Sign up with Taxsmile.

- Enter the relevant details or upload your form16. Taxsmile generates your return based on this data.

- View your tax computation absolutely FREE!

- Make a payment to Taxsmile based on the Filing Plan you chose.

- Authorise Taxsmile to efile your Income Tax Return.

- Receive via email the ITR-V.

- e-verify the return or sign and post the ITR-V.

Does Taxsmile support manual preparation and filing of Income Tax Returns?

Yes, Taxsmile supports manual preparation and electronic filing by assisted mode of Do It For Me on a chargeable basis.

Does Taxsmile calculate the Tax Refunds that I am eligible for?

Yes. In fact, as you enter your details in the relevant sections, our system updates

and remembers your taxable income and tax payable figures.

Once you have entered all the required information, the tax payable by you or refund

due to you will be displayed onscreen. So rest assured - the Taxsmile website is

not just a tax estimating tool, but a complete return preparation and filing portal!

What are the methods of e-Filing an Income Tax Return using Taxsmile?

Taxsmile can help you e-File your return by following the below steps:

- Prepare your return on Taxsmile.

- Review your Tax Calculation.

- Get your Income tax Return generated in electronic format.

- Authorize Taxsmile to e-File your Return.

- Get ITR-V from Income Tax Department in your mail box.

- Download and print ITR-V, available under your Taxsmile account.

-

Sign with "Blue" ink, enclose it in an A-4 size envelope. Send this envelope by

ordinary or speed post to

"Income Tax Department – CPC, Post Box No.1,

Electronic City Post Office, Bangalore – 560500, Karnataka"

within

120 days

of e-Filing. - Receive e-mail from Income Tax Department, acknowledging the receipt of ITR-V. That is your final acknowledgement. That concludes your efiling.

- The last three steps can be skipped by e-verifying the return electronically.

What steps are to be followed when I e-File without using a Digital Signature?

When you e-File without using a Digital Signature, you receive ITR-V as an attachment in the e-mail sent by the Income Tax Department. Since the return you filed was not signed, your filing is still incomplete. To complete the return filing process, follow the below mentioned steps -

- Print and sign ITR-V.

- Do not fold this signed ITR-V. Enclose the same in A-4 size envelope.

-

Mail the envelope within 120 days of e-Filing to –

Income Tax Department CPC

Post Box No.1,

Electronic City Post Office,

Bangalore 560500, Karnataka. - Upon receipt of ITR-V, Income Tax Department will send an e-mail acknowledging the receipt of signed copy of ITR-V. This is your acknowledgement.

- Your filing is now complete..

What is an ITR-V?

- ITR-V stands for 'Income Tax Return – Verification' form.

- This form is received when you e-File without using a digital signature.

- Income Tax Department needs to verify the authenticity of income tax return when filed online without using a digital signature.

- On receipt of ITR-V you have to sign the copy and submit to the Income Tax Department to complete the filing process.

Can I submit ITR-V anywhere else in India?

No, you cannot. You have to compulsorily mail your ITR-V in a sealed A-4 envelope to the address mentioned above.

Is there any time limit for submitting ITR-V to Income Tax Department?

Yes, you should mail your ITR-V within 120 days of e-Filing your return.

Which ITR is applicable to me?

Tax smile has been designed to automatically selects the ITR applicable to you based on the income and loss details entered by you for filing.

The following is the ITR that would be applicable to you

| ITR 1 |

|

For Individuals having Income from Salaries, one house property, other sources

(Interest etc.) and having total income up to Rs.50 lakh. Cannot use this form if you have:

|

What is Revised Return and can I file a Revised Return using Taxsmile?

If you discover any omission or any wrong statement in the return filed within due date of filing, you may file a revised return at any time before 31-03-2021 or before the completion of the assessment, whichever is earlier.

Whom should I contact in case I have queries / difficulties?

Taxsmile's Customer Support team will be happy to help resolve all your doubts and queries. You can write to us at info@taxsmile.com .

I think online filing could be more complex than physical filing. Can Taxsmile help me if I need it?

With Taxsmile, you can confidently prepare and file your Income Tax Return on your own. We believe you can, because:

- You are guided through simple interactive screens with online help available at each step.

- If you have basic queries like navigating through the website, printing your return etc., you can contact us by email.

- Your tax calculations are done by intelligent algorithms that are built into our website and incorporate the latest updates. So you do not have to bother about tax laws and updates. Our system does it all!

Actually, filing returns online is not at all difficult. Read the feedback from other customers just like you about filing using Taxsmile.

How secure is my data with Taxsmile?

Taxsmile protects your data in several ways.

- Taxsmile uses globally accepted 128-bit encryption Secure Sockets Layer (SSL) technology to protect your data while being transmitted from your computer to its data servers. This technology is used by banks globally, and offers the highest level of protection against any third-party intrusion.

- Taxsmile servers are secured with firewalls to safeguard your data from viruses and unauthorized intrusion attacks. They are monitored around-the-clock for any denial of service or intrusion attacks.

- As a registered user of Taxsmile, you can access your data through a unique password, which you create when you register for our service. Since your password is unique to you, only you can access your data. We have implemented a stringent security policy to protect your data against unauthorized access.